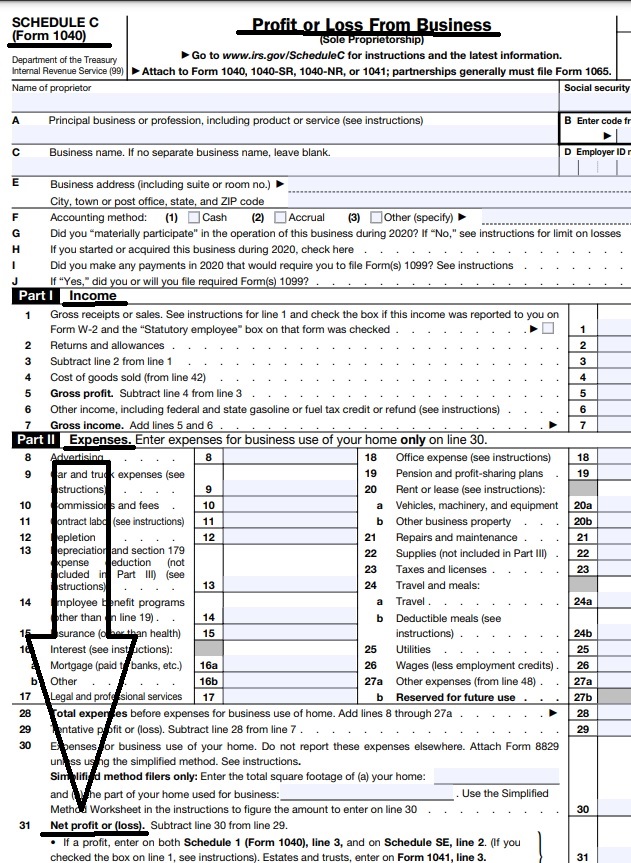

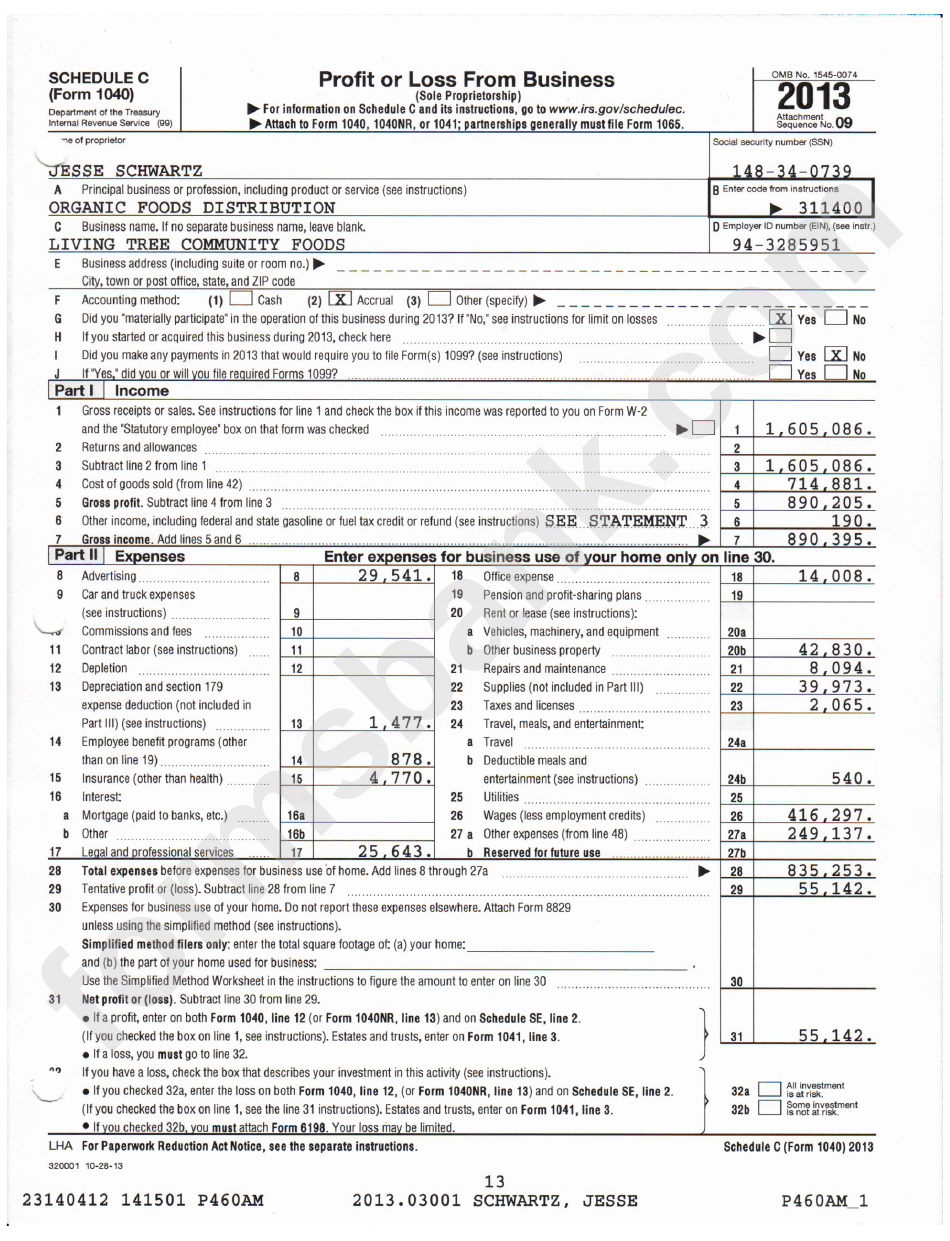

2025 Irs Schedule C - Irs Schedule C Instructions 2025 carte de voeu, Schedule c is a tax form used by unincorporated sole proprietors to report their business income and expenses. Form 1040 Schedule C Sample Profit Or Loss From Business printable, Here's an introduction to schedule c and its sister form, schedule se, plus a few tips to help.

Irs Schedule C Instructions 2025 carte de voeu, Schedule c is a tax form used by unincorporated sole proprietors to report their business income and expenses.

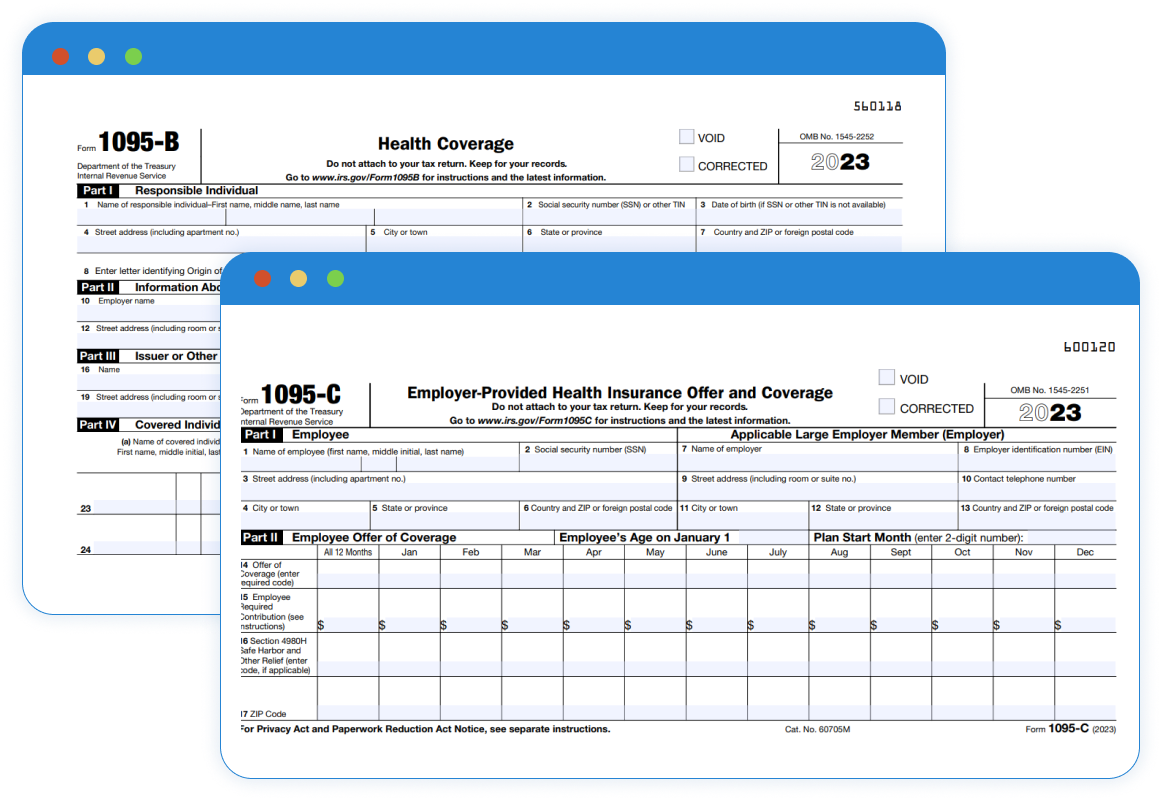

2025 2025 Schedule 3 Online File PDF Schedules TaxUni, Online competitor data is extrapolated from press.

Tax Calculator 2025 Irs John Walker, If you’re in a partnership, you’ll report those expenses on form 1065,.

2025 Instructions For Schedule C Sam Leslie, Schedule c is a tax form used by unincorporated sole proprietors to report their business income and expenses.

:max_bytes(150000):strip_icc()/ScheduleD-CapitalGainsandLosses-1-d651471c24974ac79739e2ef580b1c35.png)

Employees will adjust tax accounts using an internally generated transcript in a manner that. Schedule c is a tax form used by unincorporated sole proprietors to report their business income and expenses.

IRS Schedule C Walkthrough (Profit or Loss from Business) YouTube, This could be income from your small.

2025 Irs Schedule C gracie henrietta, This could be income from your small.

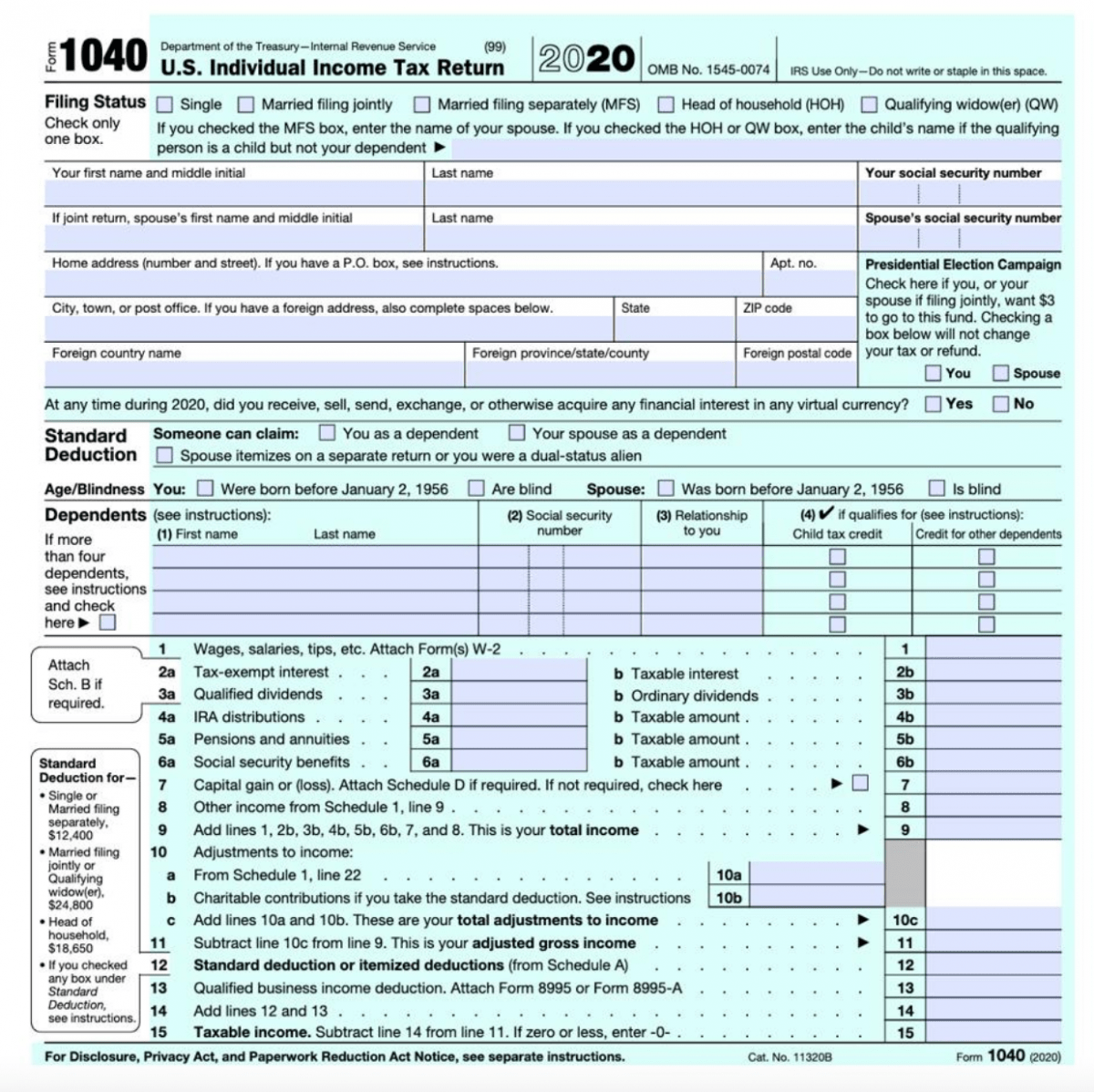

Blank Irs Schedule C Ez Fill Out and Print PDFs, The due date for personal income tax filing is april 15, 2025, assuming you’re a calendar year filer and your tax year ends on dec.

2025 Irs Schedule C. If you’re a sole proprietor, you’ll deduct meals and entertainment on form 1040, schedule c, line 24b. Individuals must prioritize understanding these tax return deadlines to maintain compliance with irs regulations.

IRS Schedule C Instructions Business Profit or Loss, Here's an introduction to schedule c and its sister form, schedule se, plus a few tips to help.